Reliance’s buyout offer to LyondellBasell November 22, 2009

Posted by Manish Katyan in Mergers & Acquisitions.trackback

Reliance Industries Ltd. made a cash offer on 22nd Nov 2009 to buy a controlling stake in closely held LyondellBasell Industries AF, the bankrupt chemicals and fuels maker. The buyout would be coordinated with emergence from bankruptcy and represents a “potential alternative” to its reorganization plan. The offer is subject to due diligence and sufficient creditor support.

The acquisition would help Reliance expand beyond its customer base in Asia into Europe and North America to become a global player.

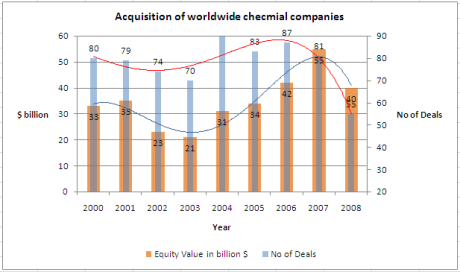

Mergers & Acquisitions: Chemical Industry

Data SourceM&A: Highlights

- The demand in the chemicals industry is not expected to return to 2007 levels before 2011 resulting in sharp decline in M&A activities. Companies are more focusing on survival than on growth.

- Deal volume declined significantly during the first quarter of 2009 amid concerns over diminished demand and liquidity. During this period, 143 deals were announced, a 31 percent decline from fourth quarter 2008 and a 7 percent decrease from the first quarter 2008. Furthermore, deal activity concerning transactions with a disclosed value greater than $50 million (58 deals) plummeted 55 percent compared with the first quarter 2008.

- Merger attempts by US chemical producer Huntsman with rival Hexion failed in December 2008 amid concerns over solvency of merged entity. Huntsman missed its target for 2nd half of 2007 and its debt increased by $1.24 billion. Credit Suisse and Deutche bank refused to provide loans of $10 billion for acquisitions. Finally, Huntsman had to settle for $1 billion to end its controversial multi-billion dollar merger deal.

M& A: Drivers

Typically above acquisitions have involved high premium. However high premiums can be justified only by cost synergies or revenue (or profit-growth) expectations. But revenue synergies are difficult to quantify and more difficult to realize in current economy slump. Hence most value calculations are based on cost synergies in areas such as administration, procurement, sales and R&D.

Acquisition Strategy

Due to current global economic conditions and debt markets, deal valuations and business cases for new deals, particularly large deals, will receive significant scrutiny from lenders. Current downturn has resulted in fundamental demand drop and increased emphasis on working capital management/destocking of the supply chain. Hence some companies are forced to remove production capacity (both permanently and temporarily).

Hence acquisitions during this period requires additional due diligence to analyze the true performance of the business being acquired as the historical financials may not clearly reflect the impact of all the events taking place in the supply chain. This requires thorough analysis both upstream and downstream in order to access the health of the segment’s supply chain, underlying health of the suppliers and customers and enforceability of the contracts and other agreements. It also means assessing profitability at the plant level in order to minimize the risk of unknowingly acquiring plants that require shut-down or significant restructuring in order to operate profitably going forward.

Industry growth prospect: Middle East and China

While many USA and European companies are focusing on riding out of the economy downturn, rationalizing portfolio and selling off distressed or non-performing assets, companies in the Middle East are gearing up by buy ready-built businesses at low prices, holding some of the mega projects in the pipeline while they are pursuing acquisitions strategy. The advantages ofsuch acquisitions include ready accessto Western technologies and markets.

Global ambition of these companies are fueled by the explosive growth of chemical industry in Middle East particularly in Saudi Arabia, Abu Dhabi, Quatar and Kuwait leveraging advantage of cheep feedstock. As per KPMG, The massive capacity expansion in bulk chemicals in the Middle East between now and 2015 may make up to 20 percent of the European petrochemicals industry uncompetitive. This will reinforce the desire of Western chemical players to move away from bulk chemicals into downstream specialty chemicals with innovative, sustainable solutions that help them stay ahead of emerging market competition.

Government’s massive stimulus plan has helped chemical companies and end consumers of their products in China. Led by the Government’s focus on becoming independent in petrochemical products (China currently imports 50% of its chemical needs), Chinese companies are on thelookout for distressed Western assetsat good prices as a move to ensure thisindependence, while simultaneously securing the same benefits of technology,know-how, and improved market accessthat are driving corporate buyers in theMiddle East.

A major advantage that Chinese and MiddleEastern chemical players share is readyaccess to cash. These companies aregenerally under at least partial governmentownership — governments which are cashrichfrom the proceeds of nearly a decadeof rising global trade and high oil prices.

Forecast top ten petro-chemical producers by 2015 (KPMG, Nov 2009)

- SABIC (Saudi-Arabia)

- BASF (D)

- Dow Chemical (USA)

- China National Petroleum Corporation (China)

- China National Chemical Corporation (China)

- DuPont (USA)

- Reliance (India)

- ExxonMobil (US)

- IPIC (Abu Dhabi)

- PIC (Kuwait)

Fact Sheet

LyondellBasell Industries(LBI)

- LBI is privately held multinational chemical company based in the Netherlands.

- It was formed in December 2007 by the acquisition of Lyondell Chemical Company (the third-largest independent, US-based chemicals company, headquartered in Houston, Texas) by Basell Polyolefins for $12.7 billion. Basell Polyolefins is owned by Access Industries, a privately held, U.S.-based industrial group.

- Lyondell was delisted from the New York Stock Exchange after the acquisition.

- In January 2009, LBI’s US operations filed for Chapter 11 bankruptcy.

- LBI is the global leader in propylene oxide production and the largest North American supplier of styrene monomer. Other products include ethylene, ETBE, polyethylene, and polypropylene.

- Sales in 2008 were $50.7 billion. The company has 60 manufacturing sites in 19 countries and 15,000 employees.

Reliance Industries Limited (RIL)

- RIL is India’s largest private sector conglomerate (by market value) and second largest in the world (Ranked 206th in Fortune Global500, 2008), with an annual turnover of US$ 35.9 billion and profit of US$ 4.85 billion for the fiscal year ending in March 2008.

- Reliance has more than 3 million shareholders (1 out of every 4 Indian stockholders), making it one of the worlds’s most widely held stock.

- RIL has wide range of products: petroleum products, petrochemicals, oil and gas exploration and production, garments (Vimal brand), Reliance Retail, Reliance Life Sciences, Reliance Solar and Reliance Logistics.

Good work!